Bitcoin Price Plummets Amid Global Market Turmoil

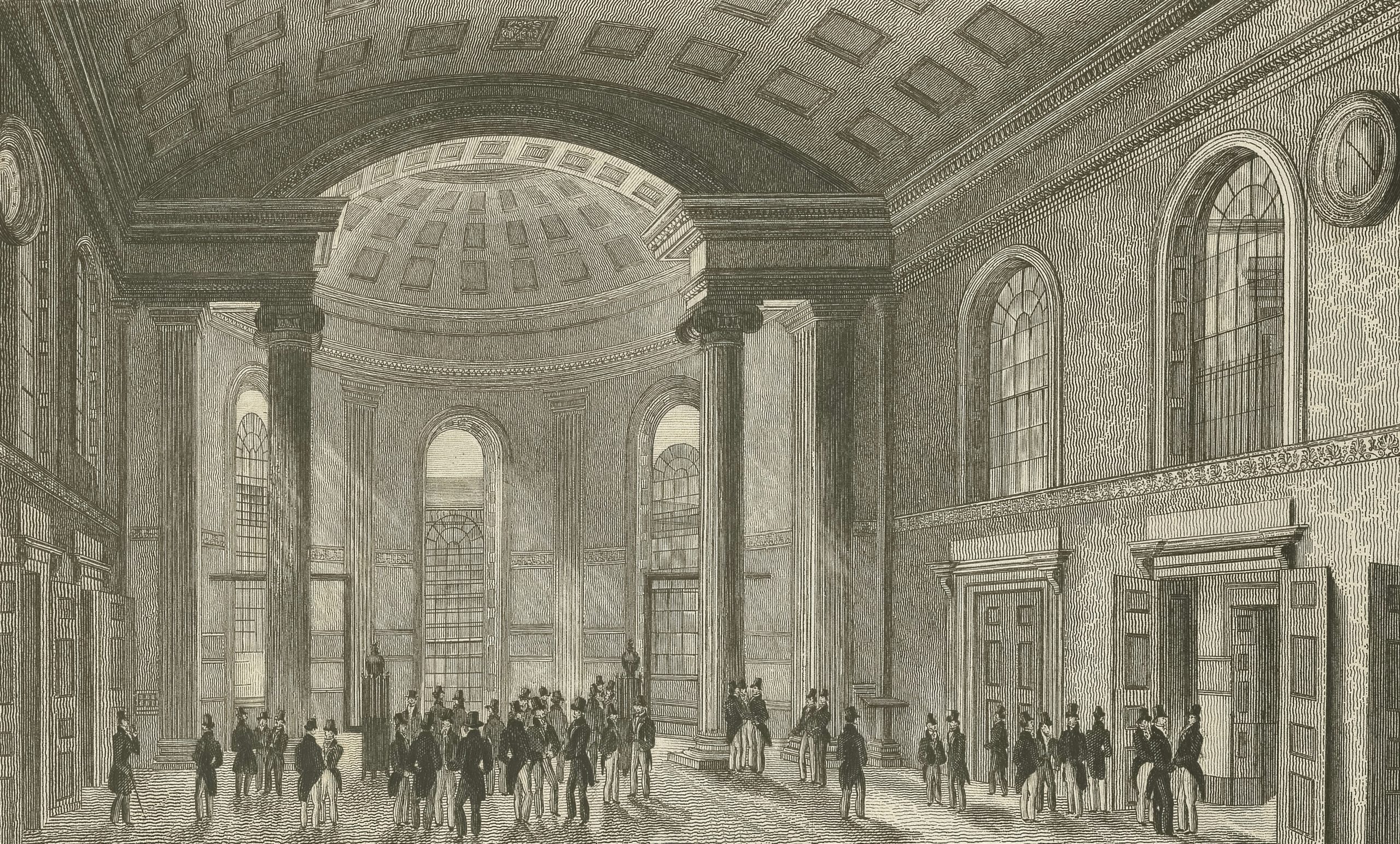

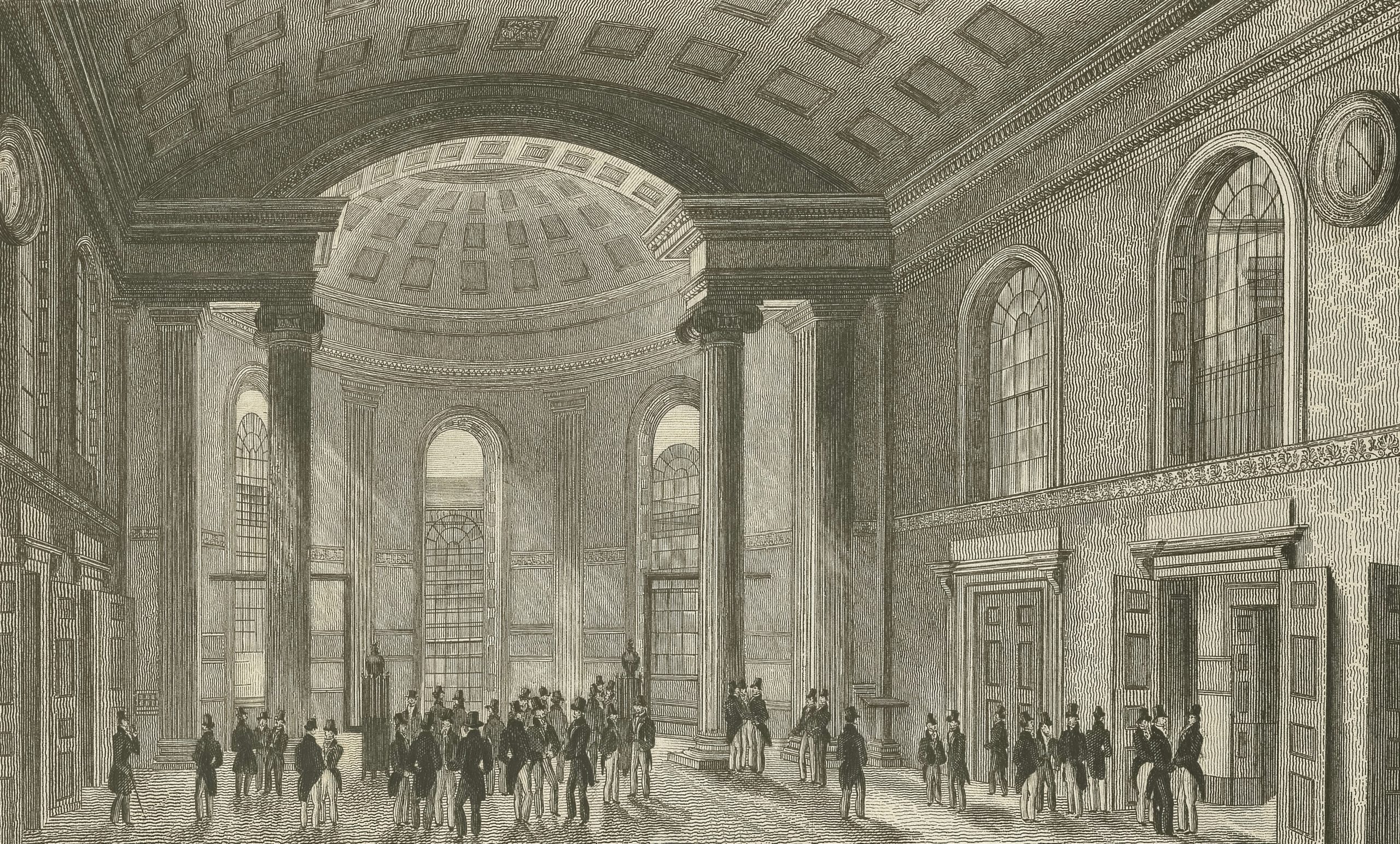

In a dramatic turn of events, the cryptocurrency market has been rocked by significant downturns, with Bitcoin leading the charge. The world's foremost digital currency witnessed a staggering drop of 15% in value within a mere 24-hour period, igniting concerns among investors and analysts alike. As the global stock markets experienced considerable losses, particularly across Europe and Asia, many investors sought refuge from riskier assets, resulting in an intensified sell-off in cryptocurrencies.

Bitcoin's price fell below the critical threshold of USD 50,000 for the first time in six months, providing a stark reminder of the volatility inherent in the digital currency landscape. This decline did not occur in isolation; it was part of a broader economic upheaval, with stock exchanges facing significant pressure as investors reacted to macroeconomic indicators and geopolitical tensions.

Arthur Hayes, co-founder of BitMEX, speculated that the recent fluctuation in Bitcoin's price might be influenced by anticipated changes in U.S. monetary policy, particularly in light of Japan's increasing interest rates. Hayes suggested that further money printing by the U.S. could be on the horizon as policymakers respond to these shifting economic conditions. Such developments could have profound implications for Bitcoin and the wider crypto market, potentially leading to increased volatility.

Analysts note that the current market environment reflects a departure from the bullish sentiments that characterized the earlier part of the year. Notably, Bitcoin's price chart has indicated a series of dips, culminating in the recent plunge that has left traders and investors on edge. The implications of this downturn extend beyond Bitcoin, as altcoins like Ether have also experienced their most significant drops since 2021.

The events of recent days underscore the interconnectedness of traditional financial markets and the cryptocurrency sector. As the carry trading strategy, which previously thrived in favorable market conditions, begins to falter, investors are reevaluating their positions. Market sentiment is increasingly cautious, with many opting for safer investments amid fears of a prolonged economic downturn.

In summary, the cryptocurrency market is facing a critical juncture as Bitcoin's price continues to fluctuate under the weight of global economic pressures. The coming days will be pivotal as investors monitor for signs of recovery or further declines. The volatility of Bitcoin and the broader crypto ecosystem serves as a potent reminder of the risks associated with digital assets. As the situation unfolds, all eyes will be on monetary policy decisions and their potential impact on market stability.